Notification for PAN India HDFC Banking Facilitator Service Live

The Banking service from HDFC Bank CSP is launched at CSC Portal. This means that all the VLEs who have applied on the https://bankmitra.csccloud.in/ and whose Zero balance Current account has been opened in the HDFC bank will now be able to offer the following services of HDFC bank to their customers.

Types of Account in Hdfc Bank CSP

- Saving Account

- Current Account

- Proprietary Current Account

Loan Sevice in Hdfc Bank CSP

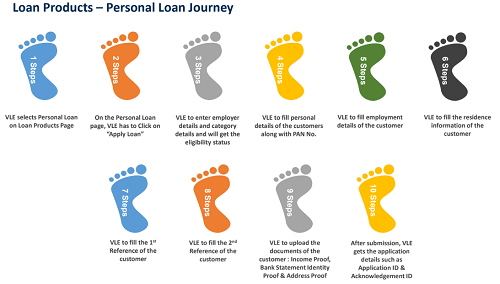

- Personal Loan

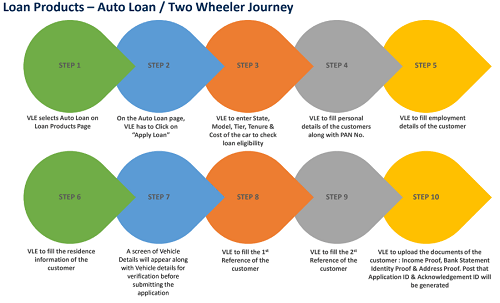

- Auto Loan

- Two Wheeler Loan

- Sustainable Livelihood Initiative (SLI)/

- Joint Lability

- Group Loan (JLG)

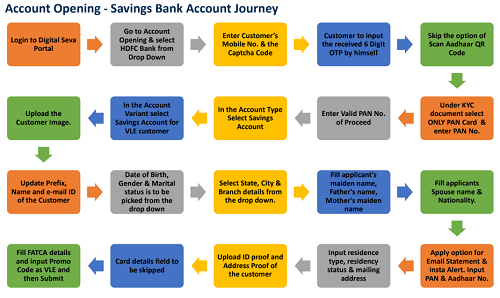

Click here for Hdfc Bank CSP Account Opening Process Flow:

https://drive.google.com/file/d/1mrwL9vQCcbyUzkORfSYa-yKaQyvUOsvk/view?usp=sharing

HDFC BANK VLE Commission List for Above Products:

https://drive.google.com/file/d/13BP2v79UCIekALpi9MRUDy4Bldzzcnwv/view?usp=sharing

Note:

Above mentioned services will be visible to HDFC Bank Approved VLEs only. Banking Portal registration (https://bankmitra.csccloud.in/ ) is mandatory to avail HDFC Financial Services.

For more information, Kindly contact your District Manager (Contact List available on http://bankmitra.csccloud.in/dm_detail.php) or mail us at banking@csc.gov.in

Soon we are arranging training in your district, keep in touch with district manager for upcoming HDFC training.

Read more:-

HDFC Bank CSP Financial Services Activation Process in CSC

HDFC Bank CSP live for Account opening in CSC

HDFC Bank Personal Loan

Rates offered to customer during the period of July’18 to Sept’18

.

.

Documents required for personal loan:

- Identity proof

- DRIVING LICENSE

- PASSPORT COPY

- VOTERS ID CARD

- PAN CARD

- CENTRAL/STATE GOVT ID CARD

- Address proof

- PASSPORT COPY

- PHOTO DRIVING LICENSE WITH DOB

- VOTERS ID

- ELECTRICITY BILL

- TELEPHONE BILL

- LEAVE & LICENSE AGREEMENT COPY

- COMPANY ACCO LETTER-CAT A & CAT B

- OTHER BANK STMT

- TELEPHONE / MOBILE PROOF

- Bank statement

- BANK ST >= 6 MONTHS

- BANK ST 3 TO 5 MONTHS

- BANK ST LESS THAN 3 MONTHS

- Income Proof

- FORM 16

- APPOINTMENT LETTER

- SALARY SLIP – LAST 3 MONTHS

- IT RETURNS – LAST 2 YRS

Eligibility HDFC Bank Personal Loan

The following people are eligible to apply for a Personal Loan:

- Employees of private limited companies, employees from public sector undertakings, including central, state and local bodies

- Individuals between 21 and 60 years of age

- Individuals who have had a job for at least 2 years, with a minimum of 1 year with the current employer

- Those who earn a minimum of Rs. 15,000 net income per month (Rs. 20,000 in Mumbai, Delhi, Bengaluru, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, Cochin)

HDFC Two Wheeler Loan

Document List & Eligibility

The following people are eligible to apply for a Two Wheeler Loan:

- A salaried or self-employed individual

- Individuals who are a minimum of 21 years of age at the time of applying for the loan, and no older than 65 at the end of the loan tenure

- Those who earn a minimum gross income of Rs. 84,000 per year for a salaried profile, and Rs. 72,000/- per year for a self-employed profile

- Individuals who have been residing at the given residence for a minimum of 1 year (in case of transfer from another location with less than 1 year at the current location, kindly provide relevant documents to the bank during loan approval stage)

- Those who have been working for a minimum of 1 year

- Individuals who have a telephone/office landline connection

Eligibility

- Agri Profile

- 3 months’ bank statement

- KYC

- Land Document

- Salaried

- KYC

- 3 months’ bank statement with 3 credits seen in banking

- Latest Form 16

- Latest ITR

- Salary Slip

- Self Employed/Proprietor/HUF

- Latest ITR or Previous ITR with advance challan with current taxes paid or latest assessment order

- 3 m Banking

- Self Employed with Rental Income

- 3 months’ bank statement

- Latest ITR & Rent Agreement

- TDS showing tax deducted from rental income

- >3 Rental credit seen in HDFC banking or >6 Rental credit seen in HDFC banking

PDD Collection Charges are refundable in case of loan cancellation.

HDFC BANK Auto Loan

Enclosed below are HDFC Bank New Car Loans Interest Rates & Charges

Inter State NOC

Refundable Security Deposit (non-interest bearing) of Rs. 5000 will be taken. It will be the borrower’s responsibility to provide the transferred Registration certificate to the bank. In addition NOC charge would be Rs. 500/-

It is also advised, that the customers should refrain from any dealings in cash with the Bank’s Direct Sales associates. Borrowers should also not make any payments in cash/bearer cheque or kind in connection with the loan, to the executive, dealing with the borrower for purpose of the loan.

HDFC Bank Eligibility &List of Acceptable Documents

Salaried:

- Any of the following age proof documents:

- Passport

- PAN Card

- Voters ID Card

- Photo Driving License with DOB (recent, legible, laminated)

- Photo Ration Card with DOB

- Employer Certificate/ID

- School/College Leaving Certificate

- Any of the following documents as proof of identity:

- Passport Copy

- PAN Card

- Voters ID Card

- Photo Driving License with DOB (recent, legible, laminated)

- Photo Ration Card with DOB

- All the following documents as proof of income:

- Latest Salary Slip

- Latest Form 16/Latest ITR

- HDFC Bank corporate salary account statement for salary credits above Rs. 80,000 for the previous 3 months

- Bank Statement

- Any of the following documents as address proof:

- Photo Ration Card with DOB

- Photo Driving License with DOB (recent, legible, laminated)

- Passport Copy

- Telephone Bill

- Electricity Bill

- Credit Card Statement with Credit Card Copy

- Employer Certificate/ID

- Any of the following as sign verification proof:

- Passport Copy

- Photo Driving License with DOB (recent, legible, laminated)

- Credit Card Statement with Credit Card Copy

- Banker’s Verification

- Copy of Margin Money Paid to the Bank

Self Employed:

- Any of the following age proof documents:

- Passport

- PAN Card

- Voters ID Card

- Photo Driving License with DOB (recent, legible, laminated)

- Photo Ration Card with DOB

- Employer Certificate/ID

- School/College Leaving Certificate

- Any of the following documents as proof of identity:

- Passport Copy

- PAN Card

- Voters ID Card

- Photo Driving License with DOB (recent, legible, laminated)

- Photo Ration Card with DOB

- Latest ITR / Previous ITR with Adv. Tax paid Challan / latest IT assessment order as proof of income

- Any of the following documents as address proof:

- Photo Ration Card with DOB

- Photo Driving License with DOB (recent, legible, laminated)

- Passport Copy

- Telephone Bill

- Electricity Bill

- Credit Card Statement with Credit Card Copy

- Employer Certificate/ID

- Any of the following as sign verification proof:

- Passport Copy

- Photo Driving License with DOB (recent, legible, laminated)

- Credit Card Statement with Credit Card Copy

Regards

Team Banking