आज मैं आप लोगों को बताऊंगा Axis Bank BC commission list 2025 pdf के बारे में | CSC के द्वारा बहुत से भी VLE Axis Bank CSP लिए हैं, जिससे अकाउंट ओपनिंग और ट्रांजैक्शन का कार्य कर रहे हैं | उनको पता होना चाहिए कि प्रत्येक सर्विस पर उनको कितना कमीशन दिया जाता है | अभी एक्सिसबैंक का कमीशन Instant नहीं मिलता है,यह मंथ वाइज करके आपको Digipay के वायलेट में क्रेडिट किया जाता है | वहां से आप लोग अपना चेक कर सकते हैं कमीशन आ रहा है या नहीं |

Axis Bank BC Commission List 2025

Axis Bank CSP अभी मार्केट में बहुत सी कंपनियां दे रही है इसमें CSC ,Paynearby, Spice Money, Sahaj इत्यादि कंपनियां है जो एक्सिस बैंक की बीसी प्रदान कर रही है | जिसको भी Axis Bank CSP चाहिए इन कंपनियों से कांटेक्ट करके बहुत ही आसानी से एक्सिस बैंक का सीएसपी ले सकते हैं और अकाउंट ओपनिंग जैसे इत्यादि अनेक सर्विसेज अपने कस्टमर को provide कर सकते हैं

CSC Axis Bank Commission Chart

| |||||||||

| SR. NO. | TXN MODE | SERVICES | TYPE | VLE SHARE | |||||

| 1 | AEPS | CASH WITHDRAWAL | OFFUS | 0.32% of the total txn amount Txn Amt minimum Rs.100/- subject to maximum payout of Rs.11.2 | |||||

| 2 | AEPS | CASH WITHDRAWAL | ONUS | 0.32% of the total txn amount Txn Amt minimum Rs.100/- subject to maximum payout of Rs.4 | |||||

| 3 | AEPS | CASH DEPOSIT | ONUS | 0.32% of the total txn amount Txn Amt minimum Rs.100/- subject to maximum payout of Rs.4 | |||||

| 4 | AEPS | Fund Transfer | ONUS | 0.32% of the total txn amount Txn amt minimum 100 INR subject to maximum payout of Rs.4 | |||||

| 5 | AEPS | BALANCE ENQUIRY | OFFUS | WILL UPDATE SHORTLY | |||||

| 6 | AEPS | BALANCE ENQUIRY | ONUS | WILL UPDATE SHORTLY | |||||

| 7 | AEPS | MINI STATEMENT | OFFUS | WILL UPDATE SHORTLY | |||||

| 8 | AEPS | MINI STATEMENT | ONUS | WILL UPDATE SHORTLY | |||||

ASSETS-LOAN SERVICES & CUSTOMER ACCOUNT COMMISSION | |||

| SR. NO. | PRODUCT | SUB-PRODUCTS | VLE SHARE |

| 1 | Two Wheller Loans | – | .64% of Disbursed Amt and additional 800 INR (per case) if disbursed more than 2 cases |

| 2 | Gold Loan | – | 0.64% of Disbursed Amount up to 5 Lacs volume and .8% of Disbursed Amount above 5 Lacs volume. |

| 3 | Tractor Loan | – | .80% of Disbursed Amt and additional 800 INR (per case) if disbursed more than 2 cases |

| 4 | Auto Loan | – | .80% of Disbursed Amt and additional 800 INR (per case) if disbursed more than 2 cases |

| 5 | Cash Credit /Overdraft(SBB) | SBB Cash credit/secured overdraft | Minimum pay out of 0.08% on disbursement or 40% of processing fees whichever is higher (Per Case) |

| 6 | Business Loan (SBB) | Loan to self employeed professionals-Doctors/CA and Non- Professionals-Sole propritership/public ltd company | 0.64% of Disbursed Amount up to 2 cases and 0.8% + 800 INR (per case) of Disbursed Amount above 2 cases. (If the second slab is met, mentioned commercials applicable from first case) |

| 7 | Secured Term Loan-(SBB) | Secured Term Loan | Upto 1.99 Cr – 0.48% 2 Cr to 4.99 Cr – 0.56% >5Cr – 0.64% (Payout to be calculated on total amount disbursed per VLE.) |

| 8 | Home Loan | Asha – Home Loan | 0.4% of Disbursed Amount |

| Home improvement / renovation loan | |||

| Plot Loan | |||

| 9 | B2B Retail and MSME – (Secured Term Loan) | Loan to MSME,food processing unit etc | Upto 1.99 Cr – 0.48% 2 Cr to 4.99 Cr – 0.56% >5Cr – 0.64% (Payout to be calculated on total amount disbursed per VLE.) |

| 10 | B2B Retail and MSME – (All other facilities CC / OD / Term Loan other than Secured Term Loan, etc) | (All other facilities CC / OD / Term Loan other than Secured Term Loan, etc) | Minimum pay out of 0.08% on disbursement or 40% of processing fees whichever is higher (Per Case) |

| 11 | B2C (KCC & ODCON) | Loan to farmers/Agri Loan etc | .64% of Disbursed Amt and additional 800 INR (per case) if disbursed more than 2 cases |

| 12 | PERSONAL LOAN | Enhancement Loan/Personal Loan/Balance Transfer/BT- IN/Holiday Loan/Pre Approved Personal Loan etc | 1% of Disbursed Amount |

| 13 | LOAN AGAINST PROPERTY | Purchase of Commercial Property/LAP BT/Loan Against Residential Commercial Property | 0.4% of Disbursed Amount |

| 14 | COMMERCIAL VEHICLE | Commercial Vehicle& Construction Equipment | 0.40 % of Disbursed Amount |

| 15 | Current Account | Current Account – HV | M0 – INR 112 on account opening – NIL IP M3 – INR 144 – 2 Credit TXN & Balance Total >= INR 5,000 M6 – INR 144 – AMB >= INR 10,000 Total Pay out INR 400 |

| Current Account – Normal-Non- High Value | |||

| 16 | SAVING ACCOUNT | Savings Basic-Zero Balance Account | Rs.40 INR at the time of account opening |

| 17 | SAVING ACCOUNT | Easy Access | M0 – INR 80 on account opening – NIL IP M3 – INR 120 – 2 Credit TXN & Balance Total >= INR 2,000 M6 – INR 80 – AMB >= INR 3,000 Total Pay out INR 280 |

| 18 | KRISHI ACCOUNT | KRISHI ACCOUNT | Rs.40 INR at the time of account opening |

| 19 | B2C-(KISAN SAMARTH) | Loan for Farmers/Agriculture | 0.64% of Disbursed Amount and 0.64 % + 800 INR (per case) of Disbursed Amount above 2 cases.(If the second slab is met, mentioned commercials applicable from first case) |

| 20 | EDUCATION LOAN | Loan for Education Purpose | 0.4% On Disbursed Amount |

| 21 | Loan Against Securities | Loan against LIC policy/Mutual Funds/Govt Bonds ETC | 0.20 % On Drawing Power Set |

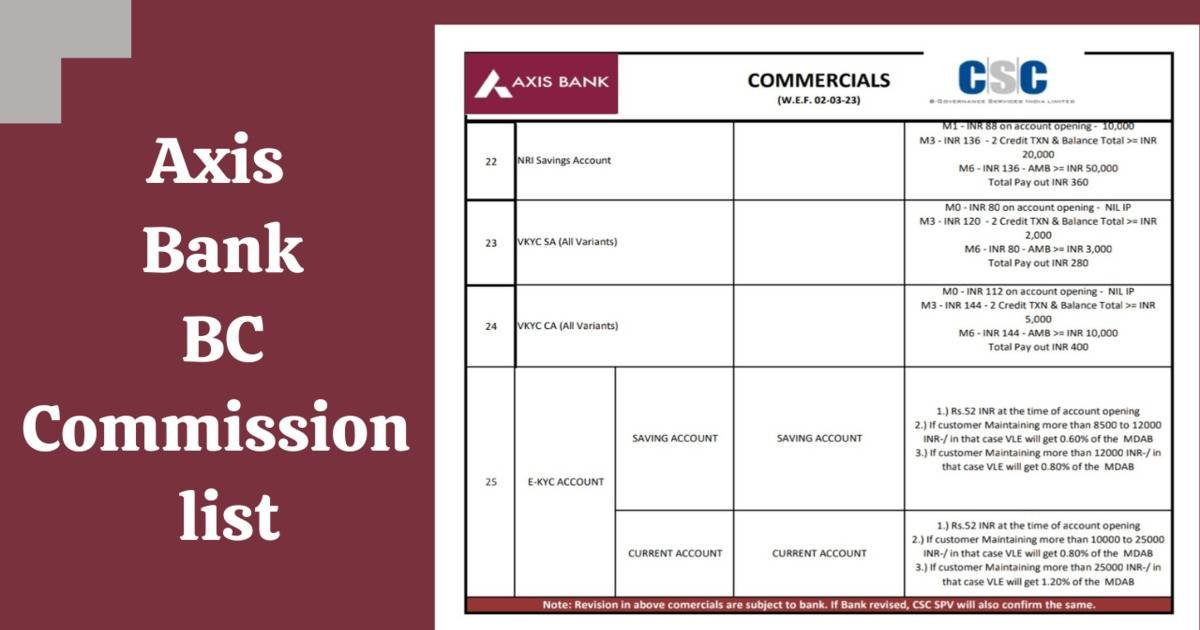

| 22 | NRI Savings Account | M1 – INR 88 on account opening – 10,000 M3 – INR 136 – 2 Credit TXN & Balance Total >= INR 20,000 M6 – INR 136 – AMB >= INR 50,000 Total Pay out INR 360 | ||

| 23 | VKYC SA (All Variants) | M0 – INR 80 on account opening – NIL IP M3 – INR 120 – 2 Credit TXN & Balance Total >= INR 2,000 M6 – INR 80 – AMB >= INR 3,000 Total Pay out INR 280 | ||

| 24 | VKYC CA (All Variants) | M0 – INR 112 on account opening – NIL IP M3 – INR 144 – 2 Credit TXN & Balance Total >= INR 5,000 M6 – INR 144 – AMB >= INR 10,000 Total Pay out INR 400 | ||

| 25 | E-KYC ACCOUNT | SAVING ACCOUNT | SAVING ACCOUNT | 1.) Rs.52 INR at the time of account opening 2.) If customer Maintaining more than 8500 to 12000 INR-/ in that case VLE will get 0.60% of the MDAB 3.) If customer Maintaining more than 12000 INR-/ in that case VLE will get 0.80% of the MDAB |

| CURRENT ACCOUNT | CURRENT ACCOUNT | 1.) Rs.52 INR at the time of account opening 2.) If the customer Maintains more than 10000 to 25000 INR-/ in that case VLE will get 0.80% of the MDAB 3.) If the customer Maintains more than 25000 INR-/ in that case VLE will get 1.20% of the MDAB | ||

| Note: Revisions in the above commercials are subject to the bank. If Bank revises, CSC SPV will also confirm the same. | ||||

Axis Bank BC Commission List Pdf Download

Below you are given the link to download the Commissioner List PDF of Axis Bank, by clicking on which you can download the PDF.

| Axis Bank BC Commission Chart Pdf | Download |