CSC HDFC BANK DUKANDAR OVERDRAFT LOAN

कम से कम तीन साल से काम कर रहे रिटेलर किसी भी बैंक से 6 महीने का बैंक स्टेटमेंट देकर ओवरड्राफ्ट सुविधा का लाभ उठा सकते हैं। बयान के आधार पर, बैंक न्यूनतम 50,000 रुपये से अधिकतम 10 लाख रुपये तक की ओवरड्राफ्ट सीमा को मंजूरी दे सकता है। इस सुविधा के लिए आवेदन करने के लिए कोई संपार्श्विक सुरक्षा, व्यावसायिक वित्तीय और आयकर रिटर्न की आवश्यकता नहीं होगी।

CSC Login कैसे करें | Login link of CSC Digital Seva Portal

सीएससी का संचालन करने वाले खुदरा विक्रेता, दुकानदार और ग्राम स्तरीय उद्यमी (वीएलई) इस सुविधा के लिए पात्र हैं। बैंक ने योजना का लाभ उठाने के लिए आवश्यक कागजी कार्रवाई और समय को कम करके प्रक्रिया को सरल बनाया है। नई योजना छोटे व्यापारियों की मौजूदा स्थिति को ध्यान में रखकर बनाई गई है। 6 साल से कम समय से चल रही दुकानों की ऊपरी सीमा 7.5 लाख रुपये और प्रतिष्ठानों के लिए 10 लाख रुपये है जो 6 साल से अधिक समय से कारोबार कर रहे हैं।

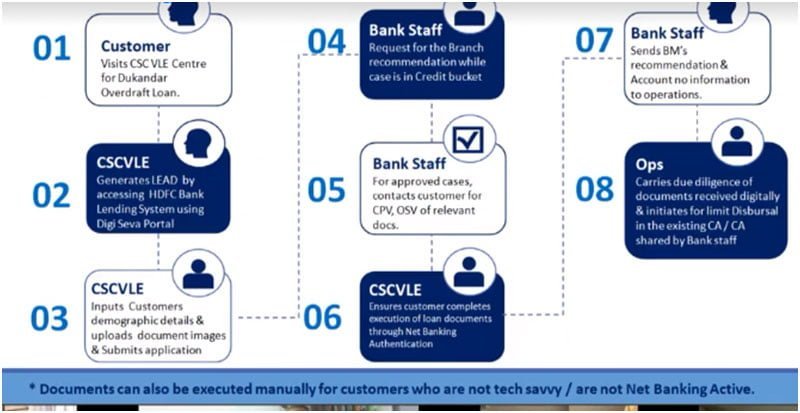

CSC HDFC Bank Shopkeeper Overdraft Loan Process

- Customer Visits CSC VLE Centre for Dukandar Overdraft Loan

- Bank Staff Request for the Branch recommendation while the case is in Credit bucket

- Bank Staff Sends BM’s recommendation & Account no information to operations.

- CSC VLE Generates LEAD by accessing HDFC Bank Lending System using Digi Seva Portal

- For approved cases, 05 contacts customer for CPV, OSV of relevant docs.

- Ops Carries due diligence of documents received digitally & initiates for limit Disbursal in the existing CA/ CA shared by Bank staff

- CSC VLE Inputs Customers demographic details & uploads document images & Submits application

- Ensures customer completes execution of loan documents through Net Banking Authentication

Complete information about CSC HDFC Bank Instant Consumer Finance Loan

Documents can also be executed manually for customers who are not tech-savvy/are not Net Banking Active.

HDFC BANK & CSC LAUNCH OVERDRAFT SCHEME FOR SMALL RETAILERS

Retailers operating for a minimum of three years can avail the overdraft facility by providing 6 months bank statement from any bank. Based on the statement, the bank may approve an overdraft limit from a minimum of Rs 50,000 to a maximum of Rs 10 lakh. No collateral security, business financials and income tax returns would be required to apply for this facility.

CSC Digipay Micro ATM की जानकारी

Retailers, shopkeepers, and Village Level Entrepreneurs (VLEs) operating the CSCs are eligible for this facility. The bank has simplified the process by minimizing the paperwork and time required to avail of the scheme. The new scheme has been created keeping in mind the current situation of small traders. The upper limit for shops operational for less than 6 years is Rs 7.5 lakh and 10 lakh for establishments that have been in business for more than 6 years.

Programme Benefits for Retailers:

- Collateral-free loan.

- Interest rate upto 16% only.

- No Commitment Charges.

Programme Benefits for VLEs:

- Commission of 0.40% to 0.80% for loan amounts of Rs 5 Lakhs and above.

- 1700+ emerging enterprise group business channel

- 600+ branches and virtual relationship management support.

HDFC BANK DUKANDAR OVERDRAFT Eligibility Criteria

- Only proprietors &business partners can apply for the overdraft facility

- A six-month statement from any bank required

- Should be a customer of the bank of which statement is furnished, for a minimum 15 months

Ms.Smita Bhagat, Country Head – Government and Institutional Businesssaid,“Over the past year, the global economy has had to contend with the unprecedented circumstances brought about by Covid19. The prevailing conditions have been particularly harsh on small businesses. HDFC Bank has launched this initiative to sustain these small retailers and shopkeepers, to help motivate and create better business opportunities. We at HDFC Bank are trying to create supportive schemes to help businesses get back on their feet before the start of the festive season.The Dukandar Overdraft scheme for shopkeepers and Village Level Entrepreneurs is a step in that direction. I am confident this will provide a much-needed relief to thousands of small traders.”

Mr.Dinesh Tyagi, Managing Director, CSC SPV said,“The Dukandar Overdraft is a practical offering, specially during these difficult and uncertain times for small shopkeepers and businesses and our VLEs alike. This will help them tide through difficulties and bounce back as the country recovers from the economic impact of Covid..”

Current Account with overdraft facility is significantly an advantageous service offered by the bank. It aids the business owner in terms of cash flow to meet their daily working capital expenses. With the overdraft facility available through their Current Account, the account holder can settle the pending payments via cheques or pay-order in a trouble-free manner. This avoids a cheque dishonor and preserves the reputation of the business owner.

Digipay Commission List For AEPS Micro ATM And Money Transfer 2021

Additionally, the RBI has maintained clean overdrafts for a small amount which are permitted at the discretion of the branch manager to the customers whose past dealings have been satisfactory. Banks may provide tailor-made schemes or services for every individual customer in this regard who maintains a Current Account with them.